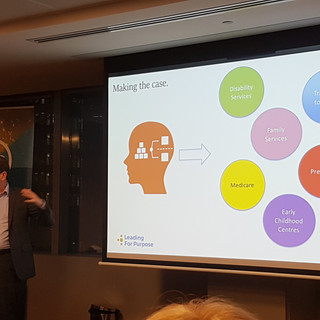

Making the case for diversified income

- Robert Crowe

- Jul 9, 2021

- 2 min read

It was a pleasure to share the floor with Simon James from HLB Mann Judd to discuss diversifying income for non profit organisations.

Any non-profit who relies on a single piece of funding, either government or benevolent, as their financial strategy is not likely to survive over the long run. For the modern non-profit, diversity of income has become a key sustainability piece that unfortunately is easier to envisage than to make a reality. An organisation founded on an idea could go out of vogue or off the needs’ radar over time.

Some non-profits exist to provide services funded by government so looking beyond their main income streams can be difficult as justification for these funds is becoming more and more strict.

There are also some exceptions, such as charities that have one big fundraiser per year that funds their works for the coming 12 months. These organisations are inclined to be for a specific purpose and provide their services in a narrow area.

Of course, there are the high profile organisations that seem to have the golden touch, such as the McGrath Foundation, OzHarvest and MS to name a few, that work extremely hard to maintain relevance and currency, attracting substantial donations and income. Similarly, The Smith Family and Cancer Council also have such highly reputable profiles that it makes it hard not to give.

How does the average non-profit navigate the world of funding and donations to maximise their survivability and achieve their purpose?

Depending upon where your income is currently derived from (given the volatility of funding sources), the board needs to look at how it can diversify, see if they can broaden the funding stream to break reliance on a single source, and search for possible new streams of funding away from their regular channels.

It’s ideal to secure at least two or more sources of income. This can be difficult for some non-profits that work in a specific area or a narrow field, but getting this right can mean it is easier to ride out peaks and troughs in cash flow.

Equally important is the balance of income even if it is diversified. Ideally, you should aim for no more than 50% from one source or have very robust risk and contingency plans that address the loss of critical income streams.

Comments